- Home

- GST

- _IGST

- __Igst act

- __igst rules

- __Igst notification

- __igst circular

- _CGST

- __cgst act

- __cgst rules

- __cgst notification

- __cgst circular

- _UTGST

- __utgst act

- __utgst rules

- __utgst notification

- __utgst circular

- _gst composition

- __gst composition act

- __gst composition rules

- __notification

- __circular

- Income Tax

- _Income Tax Act

- _Income Tax Rules

- _Income Tax Notification

- _Income Tax Circulars

- _Updates

- Company Law

- Judgements

- Finance

- _Stock Market

- Services

- _GST

- _Income Tax

- _Account & Finance

- Buy Services

Showing posts from January, 2019Show All

Analysis of Micro, Small & Medium Enterprises (MSME)

Taxonline24

January 31, 2019

Analysis of Micro, Small & Medium Enterprises (MSME) Contains Enterpris…

Immovable Property Services under GST

Taxonline24

January 28, 2019

Place of supply for Immovable Property Services under GST There is no definition …

Amendment to invoices of FY 17-18 in GSTR-1 has started on GSTN Portal

Taxonline24

January 24, 2019

Amendment to invoices of FY 17-18 in GSTR-1 has started on GSTN Portal. Finally G…

Reversal of Input Tax Credit in case of Non-payment of Consideration

Taxonline24

January 18, 2019

Reversal of Input Tax Credit in case of Non-payment of Consideration Input Tax Cre…

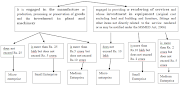

Details to be mentioned in GSTR-4

Haresh Kumar

January 15, 2019

Details to be mentioned in GSTR-4 Return by Composition Dealer GSTR-4 is a GST R…

Waiver of late fee for delay filing of GST returns

Haresh Kumar

January 12, 2019

Waiver of late fee for delay filing of GST returns by GST Council The Central Gov…

GST Update - Decisions taken by GST Council in its 32 Meeting on 10.01.2019

Haresh Kumar

January 11, 2019

GST Update - Decisions taken by GST Council in its 32 Meeting on 10.01.2019 The GS…

Important Due date Compliance Calendar for January 2019

Haresh Kumar

January 05, 2019

Important Due date Compliance Calendar for January 2019 Income Tax Act, 1961 07.…

GST Update New Services included in reversed charged (RCM) wef 01st Jan 2019)

Taxonline24

January 02, 2019

GST Update New Services included in reversed charged (RCM) wef 01st Jan 2019) In …

Social Plugin

Search This Blog

Popular Posts

How to Become a CA in First Attempt?

February 23, 2019

Analysis of Micro, Small & Medium Enterprises (MSME)

January 31, 2019

Client Area

Web Tool

Contact Form

Menu Footer Widget

Design by TemplatesYard | All Rights Reserved © 2019 TaxOnline24