Details to be mentioned in GSTR-4 Return by Composition Dealer

GSTR-4 is a GST Return that has to be filed by a Composition Dealer. Unlike a normal taxpayer who needs to furnish 3 monthly returns, a dealer opting for the composition scheme is required to furnish only 1 return which is GSTR-4. GSTR 4 has to be filed on a quarterly basis. The due date for filing GSTR 4 is 18th of the month after the end of the quarter.

Following details required to file GSTR-4:-

- Inward Supplies attracting Reverse Charge ONLY and supplies from unregistered suppliers

- Outward supplies net turnover

- Debit / Credit Note in respect of above mention supplies.

In this article we elaborate each section of GSTR-04 and the details to be provided in it.

1. Provide GSTIN:

- The taxpayer’s GSTIN will be auto-populated at the time of return filing.

2. Name of the Taxable Person:

- The taxpayer’s name will also be auto-populated at the time of logging into the common GST Portal.

3. Aggregate Turnover:

- In this section, the taxpayer has to furnish details of the previous year’s aggregate turnover, and the aggregate turnover for the period of April-June, 2017 (for the first GSTR-4 return).

4A. Registered Supplier (other than reverse charge) (B2B)

- Furnish the details of inward supplies from a registered supplier whether inter-state or intra-state (ie within state) on which reverse charge is not applicable

- Furnish the details of inward supplies from a registered supplier whether inter-state or intra-state (ie within state) on which reverse charge is applicable.

- Tax payable amount on inward supplies against reverse charge will be calculated based on these details.

- Tax paid under this head will form part of cost of inward supplies.

- No ITC availbe on tax paid under this head to composition dealer.

- Enter the details of inward supplies from an unregistered supplier whether interstate or intrastate.

- No ITC is available on tax paid under reverse charge.

- RCM on purchase from unregistered dealers has been put on hold from 13th Oct 2017. Hence RCM on purchase from unregistered dealers is still applicable up to 13th October 2017.

- Import of services on which tax is to be paid due to applicability of reverse charge.

- Only IGST and Cess will be applicable and to be paid.

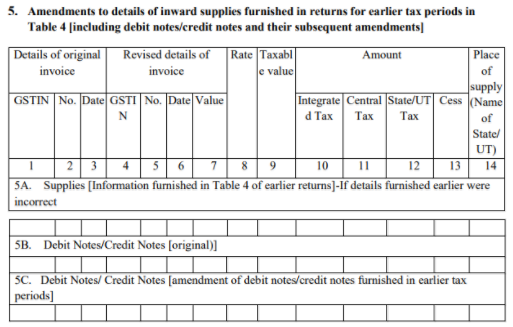

5A. Amendment of inward supplies [Information furnished in Table 4 of earlier returns]

If details furnished earlier were incorrect

- Corrections may be made under this table for any incorrect details filled in any of the heads under Table – 4

- GSTR-4 cannot be revised after filing on the GSTN Portal. Any mistake in the return can be revised in the next Quarter's return only. It means that, if a mistake is made in the GSTR-4 filed for the July-September quarter, the rectification for the same can be made only when filing the next quarter’s GSTR-4.

- Credit / Debit Note against inward supplies from registered suppliers are to be mentioned here

- Credit / Debit Note against supplies attracting reverse charge is to be mentioned here. Taxes under reverse charge will be payable net off original supplies and Credit / Debit Note.

- Since mentioning original supplies other than reverse charge is not applicable for July – September and October – December Return Period of FY 2017-18 Credit / Debit Note against such supplies is also not required to be mentioned

- Credit / Debit Note against inward supplies from an unregistered supplier is to be mentioned here

6. Tax on outward supplies made (Net of advance and goods returned)

- Enter the net turnover and select the applicable rate of tax, tax amount will be auto- computed.

- Net Turnover = Value of taxable supplies (as reflected in original invoices) + advances received – goods returned +/- Debit Notes/ Credit Notes (as the case may be).

- IGST and Cess is not applicable since a composition dealer is not eligible to make interstate supplies.

7. Amendments to Outward Supply details furnished in returns for earlier tax periods in Table No. 6:

- Any change to be made to details of sales provided in previous returns is required to be stated here along with original details.

- This will be made available from October – December Return Period of FY 2017-18

8A. Advance Amount paid for reverse charge supplies in the tax period.

(Advance Amount paid against inward supplies which tax is to be paid under reverse charge.)

8II Amendments of information furnished in Table No. 8 (I) for an earlier quarter:

(Advance Amount paid against inward supplies which tax is to be paid under reverse charge.)

- In case the invoices have already been received against these advance payment, such payments must be excluded.

8II Amendments of information furnished in Table No. 8 (I) for an earlier quarter:

- This will be made available from October – December Return Period of FY 2017-18

9. TDS Credit received:

Any TDS deducted by the supplier while making payment to the composition dealer has to be entered in this table. GSTIN of the deductor, Gross Invoice value and the TDS amount should be mentioned here.

Any TDS deducted by the supplier while making payment to the composition dealer has to be entered in this table. GSTIN of the deductor, Gross Invoice value and the TDS amount should be mentioned here.

10. Tax payable and paid:

Total tax liability and the tax paid have to be specified in this table. IGST, CGST, SGST/UTGST and Cess have to be separately mentioned here.

Total tax liability and the tax paid have to be specified in this table. IGST, CGST, SGST/UTGST and Cess have to be separately mentioned here.

11. Interest, Late Fee payable and paid:

Interest and late fees payable for late filing or late payment of GST have to be mentioned here. The interest or late fees payable and the payment actually made should also be stated in this table.

12. Refund claimed from Electronic cash ledger:

Any refund of excess taxes paid can be claimed here. The refund has to be further segregated into tax, interest, penalty, fees, and others.

Any refund of excess taxes paid can be claimed here. The refund has to be further segregated into tax, interest, penalty, fees, and others.

13. Debit entries in cash ledger for tax/ interest payment [to be populated after payment of tax and submission of return]:

All GST payments made in cash reflect here. The payments have to be further segregated into tax paid through cash, interest paid and late fees paid.

All GST payments made in cash reflect here. The payments have to be further segregated into tax paid through cash, interest paid and late fees paid.